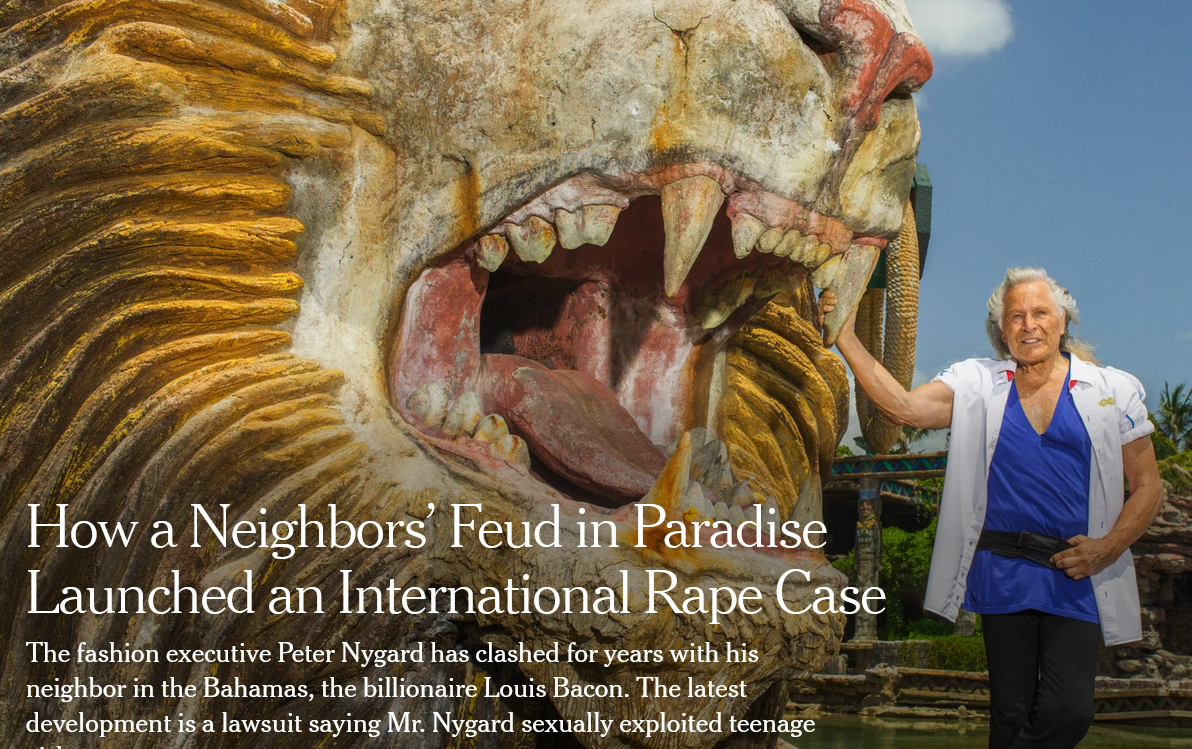

Bernie Sanders is not my #1 choice for the Democratic nomination — I think Elizabeth Warren would be a much better President — but stories like this one really make the case for the abolition of billionaires. (For the record: I’m not against billionaires per se, just for real progressive wealth taxes.)

Bernie Sanders is not my #1 choice for the Democratic nomination — I think Elizabeth Warren would be a much better President — but stories like this one really make the case for the abolition of billionaires. (For the record: I’m not against billionaires per se, just for real progressive wealth taxes.)

A Personal Blog

by Michael Froomkin

Laurie Silvers & Mitchell Rubenstein Distinguished Professor of Law

University of Miami School of Law

My Publications | e-mail

All opinions on this blog are those of the author(s) and not their employer(s) unelss otherwise specified.

Who Reads Discourse.net?

Readers describe themselves.

Please join in.Reader Map

Recent Comments

Subscribe to Blog via Email

Join 52 other subscribers