Back in November, right after it became clear that Democrats would keep a tiny grip on the Senate, and Republicans would have a small majority in the House, but only subject the hardest core rump of the ultra-rightist ‘Freedom Caucus’, the Washington Post’s Greg Sargent wrote a column (now paywalled) on 5 ways to ‘crazyproof’ the country against the chaos of a GOP House.

The five measures Sargent recommended were:

- Remove the debt ceiling

- Fix the method by which Congress ratifies the electoral vote

- “Avert chaotic gridlock on immigration”

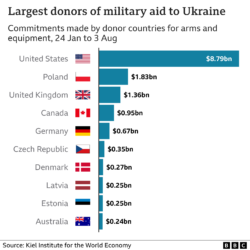

- Prevent defunding of aid to Ukraine

- Protect investigations of Trump via a long-term appropriation for the Justice Department

The lame-duck Congress only managed one in full, although it did two in part. Unfortunately, the most critical short-term fix got almost no traction at all.

Congress did pass the Electoral Count Reform Act. So that is #2 taken care of, and future Vice-Presidents should not have to worry about their boss encouraging others to threaten to kill them if the Veep doesn’t reject a state’s slate of electors.

And Congress did pass a spending bill that will fund the Justice Department for the coming year, and also has more aid for Ukraine in it. So there’s #5 good for a year, and #4 sorted until we use up the money and need more.

But there was no action on immigration, not even the DREAM Act, and worst of all the insane man-made debt limit crisis is due to raise its ugly head again fairly soon.

The debt ceiling currently stands at around $31.4 trillion, and we’re getting closer (I’ve inserted a copy of the real-time debt clock.) As we get very close the Treasury has a few games it can play to stretch things out a few weeks. There is no science to the ‘limit’ — it is just an arbitrary statutory limit, enacted to force votes to allow the US Government to pay for borrowing mandated by the gap between enacted spending and enacted taxes (aka “deficit spending”, aka “charging future generations for expenditures (some of which) pay future benefits). The original idea was to create painful votes for Democrats that lent themselves well to campaign commercials.

But the current crazies, as Sargent euphemistically describes them, have a different plan. They have vowed not to raise the debt ceiling unless Congress first cuts spending in general, and Social Security and/or Medicare in particular. You might not think this is winning politics, although it’s clear that a decent chunk of the GOP is all in for it (example).

So what happens if 41 Democrats in the Senate won’t budge and filibuster any bill that would cut bedrock entitlement plans? Then, at some point, the US can’t issue new debt, some of which would be needed to pay bills including interest on old debt, and the ‘full faith and credit’ of the US is shot. This could upend the economy and destabilize the world financial markets:

The Treasury Department is projected to hit its borrowing limit next year, though it is unclear exactly when the agency will run out of so-called extraordinary measures to ensure payments continue for a few months.

Failure to act could result in staggering consequences for the U.S. economy, forcing American officials to choose between the continuity of assistance like Social Security checks and the payment of interest on the country’s debt. The threats from Republicans recall brinkmanship in 2011, when congressional Republicans sought to pressure President Barack Obama to accept similar spending cuts in exchange for raising the debt limit.

That standoff led to the downgrading of the credit of the United States and rattled American investors and the economy.

Goldman Sachs economists warned in an analysis this week that bipartisan support to raise the debt limit “will be necessary, but hard to achieve,” and that the United States could veer the closest it had come to the economic tumult of 2011 since that standoff. The analysts also noted that less than a quarter of Republicans and less than a third of Democrats who will serve in the House in 2023 were there in 2011.

Why is that Democrats didn’t push harder to fix this? I think there are two reasons. First, the votes in the Senate needed to overcome a filibuster just were not there. There were not ten Republicans willing to go out on that limb without allowing some brinkmanship first. Second, I suspect that some Democrats, noting the wild unpopularity of previous partial government shutdowns in the face either of looming debt ce4iling or the failure to pass a budget, have decided that if the ‘ultra-MAGAS’ crowd takes it the mat they will be cutting off their own political heads.

This calculation, however, has two problems. First, it is entirely possible that the GOP as whole might get punished badly, but the instigators, who tend to come from very safe districts, will not feel the pain directly. Second, if we do have an actual default, anyone who isn’t shorting Treasuries, which is to say almost everyone, is going toe get hurt. It’s that second fact that has in the past caused either GOP leadership or rank and file to find the votes to prevent a default. If, however, Kevin McCarthy finds a way to get elected Speaker it will only be due to such major concessions to his rabid right flank that it likely will be impossible for the party leadership to act. And whether there is a handful of members willing to defy their caucus and cast a vote that might well get them the Liz Cheney treatment – expulsion from any party role, and a well-funded primary opponent — is maybe too much to hope for.

Matt Levine writes:

Matt Levine writes:

The

The