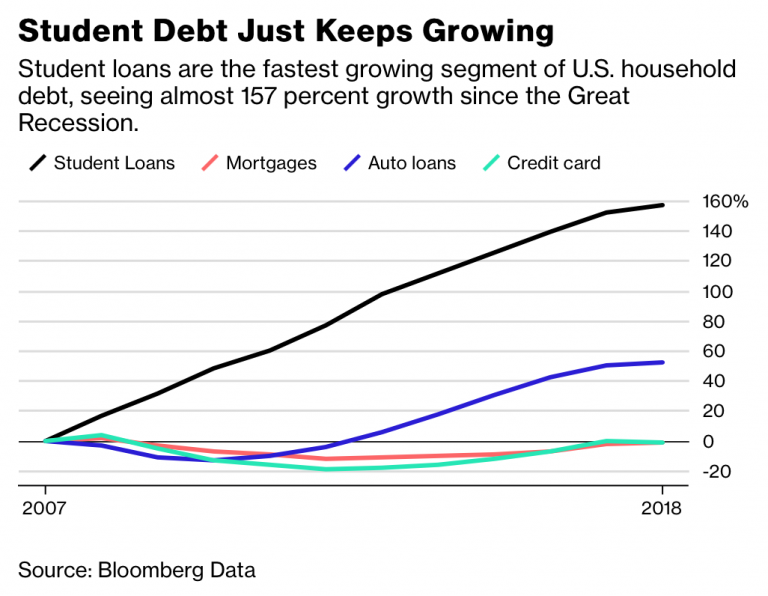

I never used to worry about the morality of teaching in a private law school. But as the debt burden grew on students, I began to worry, and charts like this one from Naked Capitalism make me worry even more.

Unfortunately, many public law schools now charge comparable tuition (but some still don’t).

In any case, student debt of this magnitude is not sustainable, and even if it were the drag on people’s futures and life choices seems excessive. I think the first part of the answer is to bring down the cost of public college: we should return to the era, not so long ago, where you could pretty much finance your college education from a summer job.

Law school prices may still be too high even in that scenario, but at least the overall consequences for students wouldn’t be as bad.

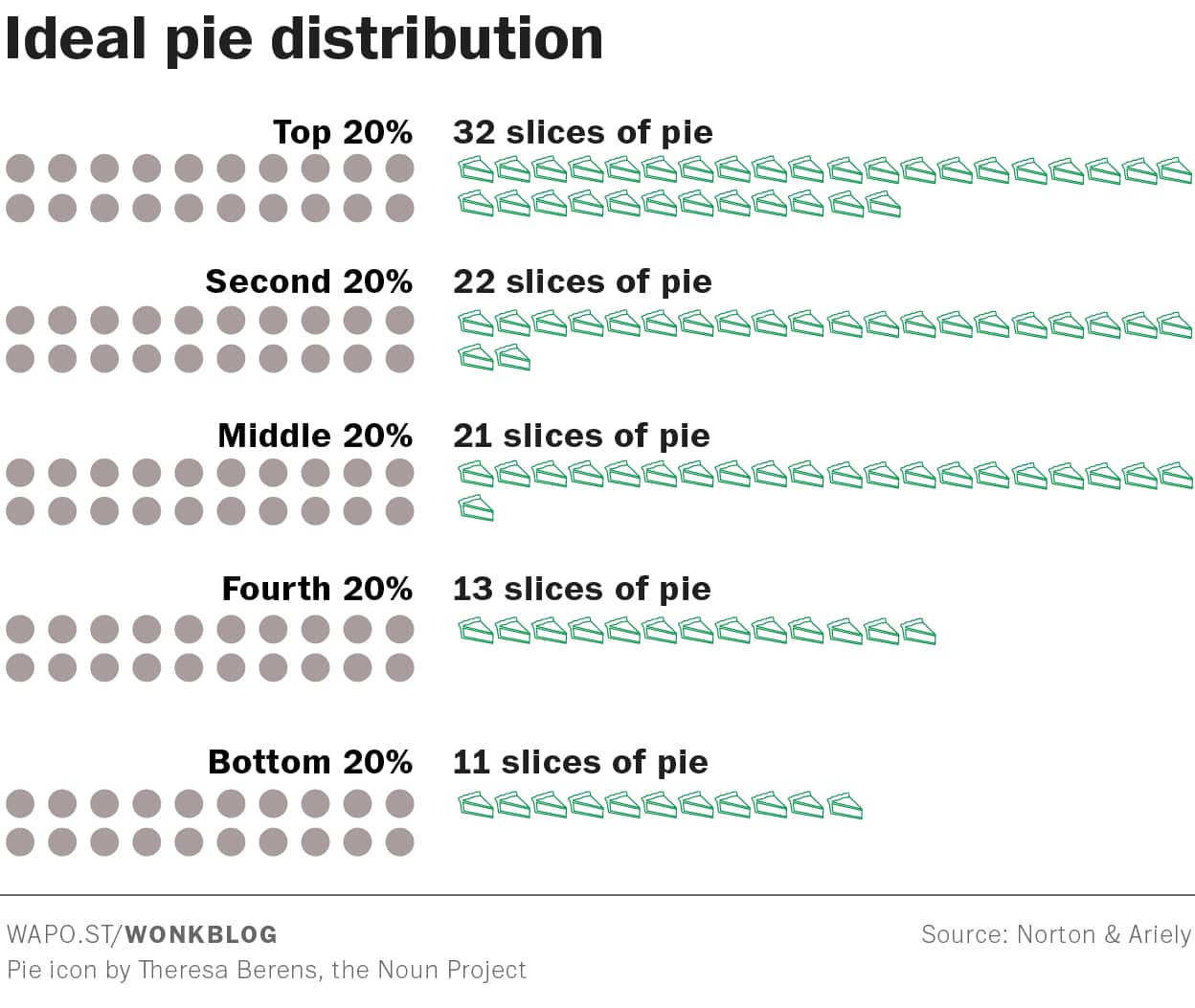

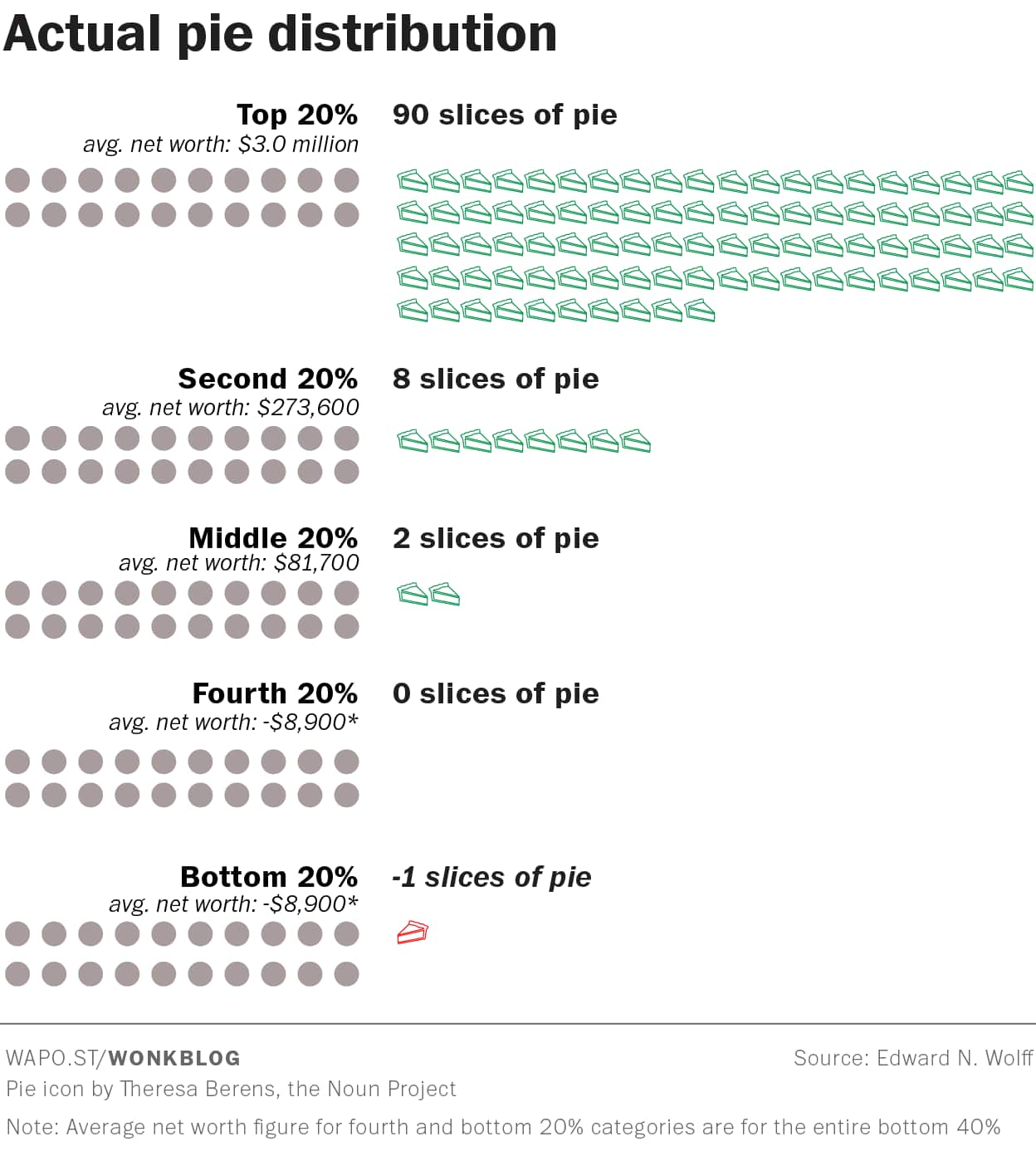

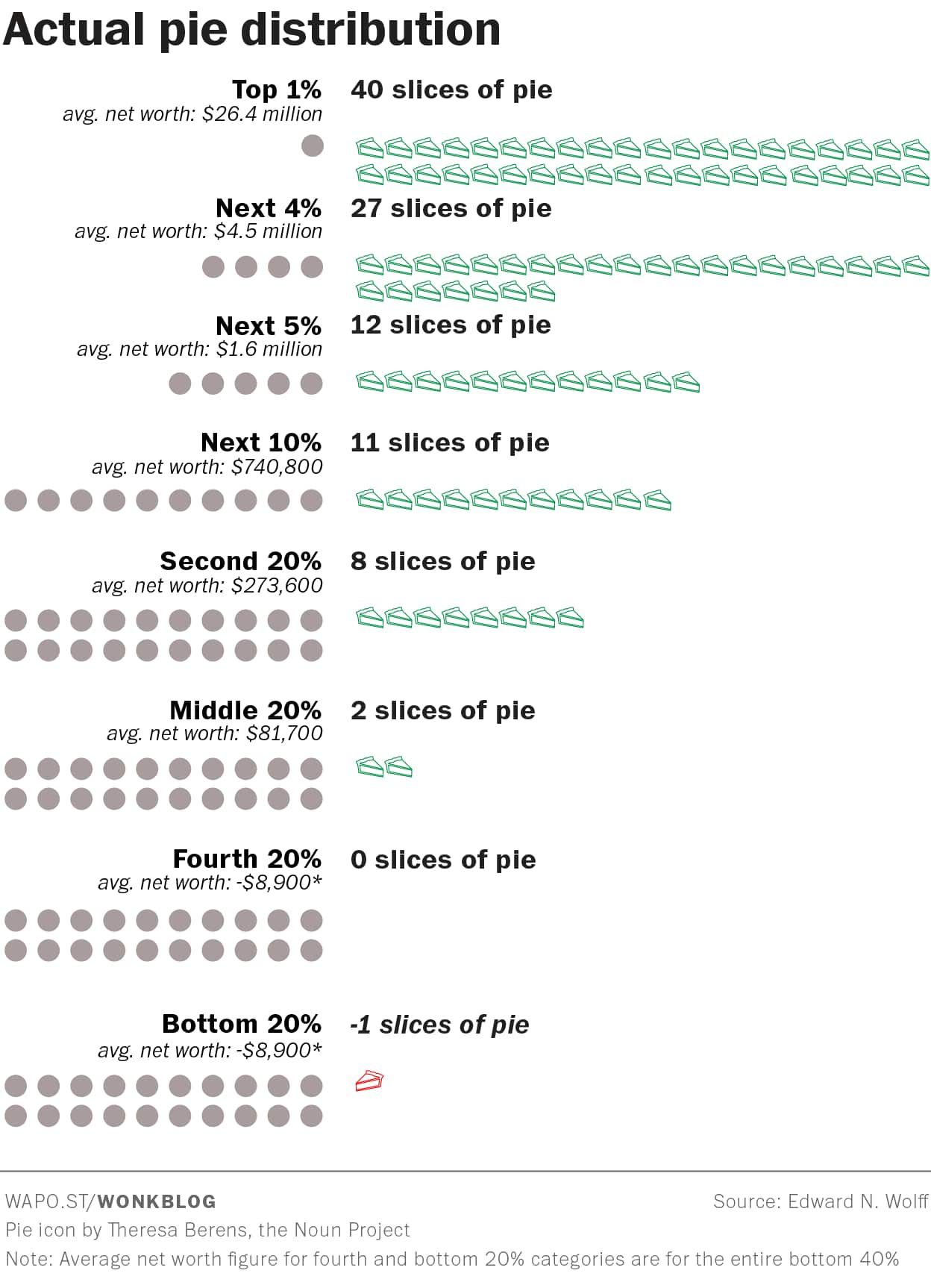

What we do with the debt overhang, meanwhile, is a wicked problem. To simply forgive the debt would be a windfall for the debtors. As a taxpayer, I could live with that; the problem that bugs me is that it seems so unfair to the people who didn’t borrow or who paid down their debt, and those who made sacrifices to finance education or chose less-expensive and perhaps lesser alternatives…or who chose to forgo education entirely.

But now there’s a new wrinkle: suppose Congress passes an eleventh-hour bill and Trump vetoes it? He hasn’t said he would in so many words, but the

But now there’s a new wrinkle: suppose Congress passes an eleventh-hour bill and Trump vetoes it? He hasn’t said he would in so many words, but the