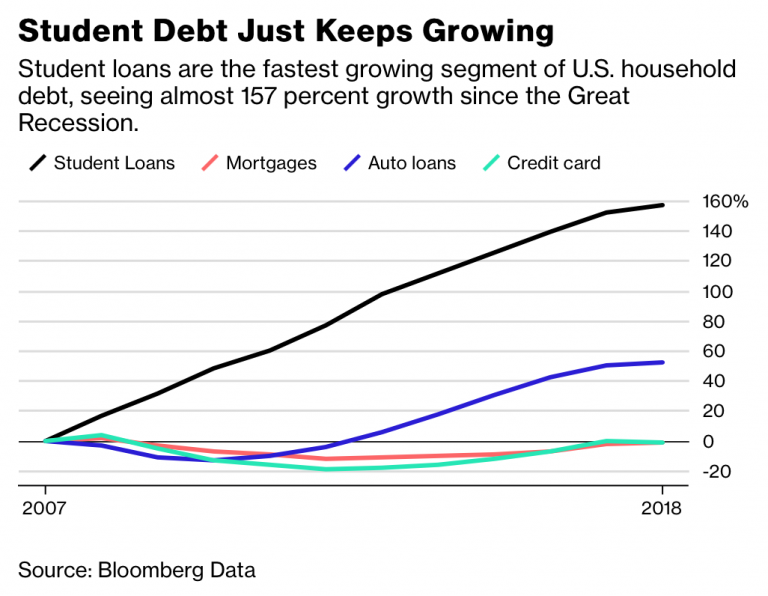

I never used to worry about the morality of teaching in a private law school. But as the debt burden grew on students, I began to worry, and charts like this one from Naked Capitalism make me worry even more.

Unfortunately, many public law schools now charge comparable tuition (but some still don’t).

In any case, student debt of this magnitude is not sustainable, and even if it were the drag on people’s futures and life choices seems excessive. I think the first part of the answer is to bring down the cost of public college: we should return to the era, not so long ago, where you could pretty much finance your college education from a summer job.

Law school prices may still be too high even in that scenario, but at least the overall consequences for students wouldn’t be as bad.

What we do with the debt overhang, meanwhile, is a wicked problem. To simply forgive the debt would be a windfall for the debtors. As a taxpayer, I could live with that; the problem that bugs me is that it seems so unfair to the people who didn’t borrow or who paid down their debt, and those who made sacrifices to finance education or chose less-expensive and perhaps lesser alternatives…or who chose to forgo education entirely.

One solution would be to reform the bankruptcy code to treat student loans like any other debt. Bankruptcy, although sometimes a good decision on balance, is no windfall. It could even be limited in some way, like, student loans become an ordinary dischargable loan if after 5 years from the date on which you are required to begin repaying them you still have in excess of $50k. This was borrowers couldn’t just rack up debt and then declare bankruptcy on their first day out of school before they have accumulated other assets that might become part of the bankruptcy estate.

I can speak to my own experience. I came out of law school with 6 figure student debt in 2006. I had done well in school, law review editor, etc. I went to work at a large/medium sized firm. I expected to do well financially. The great recession hit, the firm crumbled, jobs were scarce, and I became a solo practitioner. Being a solo was a good experience. I learned a ton about the practice of law, generating business, managing clients, and “hustling to make a living in Miami.” But, the economics were not viable under that loan burden. It was a hell of a bumpy ride from a few years.

Now, all is well. My skills have grown, career has developed, and the economy has rebounded. I still owe tens of thousand of dollars in student loans. But its in a “set it and forget” sort of status, and I have focused my savings towards family, home ownership, and 401k.

If I would have been single, had children, or if my wife would have lost her job too, it would have been impossible. For people in that circumstance, bankruptcy would have been appropriate, but the current hurdles to discharging student loan debt through bankruptcy make it virtually impossible.

You might ask why I have not made paying the student loans off a priority. Well, student loans die with me (I paid off all the private loans and have no co-signer). If something should happen to me today, I would rather my savings be in assets that I can pass on to my wife rather than paying off a debt that evaporates upon my death. And at about 5% fixed interest, and with rising inflation, paying the minimum on the loans isn’t a terrible way to handle it in the meantime.

When I took the LSAT in 2006 and entered law school in 2007, things looked pretty rosy. Then 2008 hit, and our class was caught in the recession exactly halfway through our six semesters of school. I’ll never forget sitting around campus having real discussions with fellow students about whether we should quit or finish. Some people did quit (not many), and they sure looked a lot happier than we did when we saw them around town later.

How about this? At the beginning of the fall semester in 2008, I sent in an application to Heller Ehrman for a summer associate position, only to read a headline two weeks later that Heller Ehrman – a major firm at the time – was about to file for bankruptcy. That’s when it really clicked in that our class was going to be screwed. That was followed by the whispers from the career office that Ivy League schools were calling up the whiteshoes in NY and DC and essentially begging those firms to take their students as summers – for free.

In 2015, NYT did a story on the law school class of 2010 that showed only 40% of 2010 graduates held legal jobs as of 2015. And many of those were solos who had no other choice but to become solos. Now, in 2018, assuming there has been some further attrition, I’d be willing to bet that 65% or more of 2010 grads have nothing to do with the law anymore. Sad stuff. (https://www.nytimes.com/2015/04/27/business/dealbook/burdened-with-debt-law-school-graduates-struggle-in-job-market.html)

I never did hold a legal job of any kind. Graduated with something on the order of $160,000 in total debt, and would be on the street right now if it weren’t for the advent of income-based repayment. Of course, IBR leads to payments not large enough to even begin paying down principal. So if the debt forgiveness portion of IBR is removed by Congress, I’ll literally be paying this debt until the day I die. As it is, I’ll be paying until I’m 52 and even at that point won’t really have even touched the principal. (I work in digital content marketing making about $80k a year right now).

On reflection, saying the cost of law school is a little too high would be like saying the surface of the sun is a little warm. Law schools have essentially no overhead outside of facilities and salaries, versus medical schools, which have to buy and maintain state of the art equipment. With so little expense and such massive tuition, law schools are cash cows and universities know it, which is why every podunk university with a few thousand students now seems to have a law school.

Anyway, given what happened, people ask me all the time if I regret going to law school, and the answer can only be “yes”. Learning a new way to think and having your mind opened by smart professors is worth something, but it’s not worth never-ending bills and the lack of job freedom that comes with being saddled with this much debt.

This is a huge problem. A big part of it is, like the subprime loan bubble, the people who make the loans, make all their money back, or get what the want, and pass the debt on to someone else. If schools were on the hook for at least some of this money, the system would change. As it stands, students, who have no real concept of it when they take the loans, get out of school with debt that is so big that it is surprising that they even other trying to pay it back, as it is, in some cases, simply not practical to do so.

Meanwhile, at Miami, the class sizes, and thus loan burden, expands, Miami gets its desired expanded cash, the original lender gets its cash in the form of the bundles it sells, and students are left with debt that can’t be paid, and some third party collector trying to get the money back.

Frankly, I have no intention at all of repaying my remaining debt. It dies with me, and it is unsecured. I just no longer care about it. Plus with you liberals demanding loan forgiveness constantly, and politicians pretending it might happen, only a fool would want to be the last person to have to pay. It’s a bad system and needs to be wiped clean. What other lender gives hundred thousand dollar unsecured loans to one 20 year old? It’s laughable in any other context.