[Update – 12:52 GMT] Account recovery page will be up tomorrow morning (Japan time)

We have almost completed the account recovery page and are waiting for result to unit tests and intrusion tests (and more than anything, don’t want to put something online and go to sleep just after, best way to get screwed), so the page will be put online tomorrow morning.

It will allow every user to claim ownership of their account based on proof such as deposits, withdraws, password (if complex enough), email or notarized documentation.

Once it is deemed enough users had the chance to get their account back, the exchange will be open again (opening time will be announced at least 24 hours in advance). It will still be possible to file claims for user accounts after this.

[Update – 6:30 GMT] Still here. Still working hard to get things online.

- SHA-512 multi-iteration salted hashing is in enabled and ready for when we get users reactivating their accounts

- We are going to push our relaunch time to 2:00am GMT tomorrow so we have time to launch a our new backend and withdraw passwords.

Thanks to everyone sending the supportive emails and our extremely patient users.

[Update – 3:45 GMT] DO NOT DOWNLOAD ANYTHING

If you receive ANY email which seems coming from Mt.Gox asking you to download something (certificate, generating program, etc), DO NOT DOWNLOAD. Do not either input your password on any site which is not MTGOX.COM.

[Update – 2:06 GMT] What we know and what is being done.

- It appears that someone who performs audits on our system and had read-only access to our database had their computer compromised. This allowed for someone to pull our database. The site was not compromised with a SQL injection as many are reporting, so in effect the site was not hacked.

- Two months ago we migrated from MD5 hashing to freeBSD MD5 salted hashing. The unsalted user accounts in the wild are ones that haven’t been accessed in over 2 months and are considered idle. Once we are back up we will have implemented SHA-512 multi-iteration salted hashing and all users will be required to update to a new strong password.

- We have been working with Google to ensure any gmail accounts associated with Mt.Gox user accounts have been locked and need to be reverified.

- Mt.Gox will continue to be offline as we continue our investigation, at this time we are pushing it to 8:00am GMT.

- When Mt.Gox comes back online, we will be putting all users through a new security measure to authenticate the users. This will be a mix of matching the last IP address that accessed the account, verifying their email address, account name and old password. Users will then be prompted to enter in a new strong password.

- Once Mt.Gox is back online, trades 218869~222470 will be reverted.

We will continue to update as we find new information.

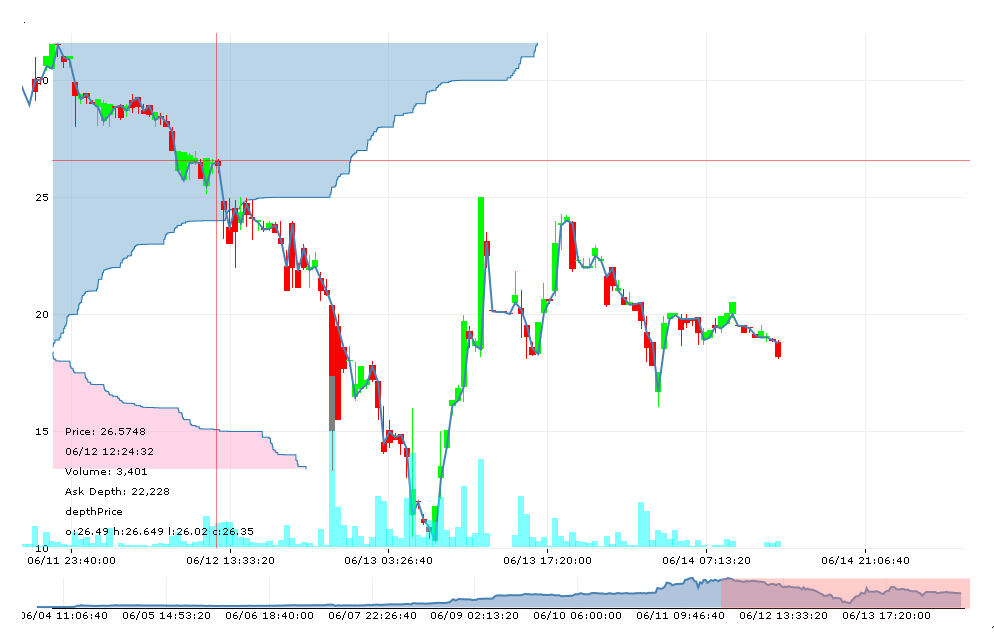

Huge Bitcoin sell off due to a compromised account – rollback

The bitcoin will be back to around 17.5$/BTC after we rollback all trades that have happened after the huge Bitcoin sale that happened on June 20th near 3:00am (JST).

One account with a lot of coins was compromised and whoever stole it (using a HK based IP to login) first sold all the coins in there, to buy those again just after, and then tried to withdraw the coins. The $1000/day withdraw limit was active for this account and the hacker could only get out with $1000 worth of coins.

Apart from this no account was compromised, and nothing was lost. Due to the large impact this had on the Bitcoin market, we will rollback every trade which happened since the big sale, and ensure this account is secure before opening access again.

UPDATE REGARDING LEAKED ACCOUNT INFORMATIONS

We will address this issue too and prevent logins from each users. Leaked information includes username, email and hashed password, which does not allow anyone to get to the actual password, should it be complex enough. If you used a simple password you will not be able to login on Mt.Gox until you change your password to something more secure. If you used the same password on different places, it is recommended to change it as soon as possible.

SERVICE RETURN

Service will not be back before June 20th 11:00am (JST, 02:00am GMT). This may be delayed depending on what is found during the investigation.

If the US hits the debt ceiling, will there be a run on the banks?

If the US hits the debt ceiling, will there be a run on the banks?