The Law School just issued this news release:

The South Florida community is ground zero for the national foreclosure crisis. In response, the University of Miami School of Law has created Foreclosure Defense Fellowships that will enable newly minted lawyers to give free help to local residents caught in the foreclosure crisis. The School of Law is one of the first schools in the nation to create a program of this kind in response to the crisis that is sweeping the country. Recent UM graduates will acquire real-world work experience and address a serious need in the community at the same time.

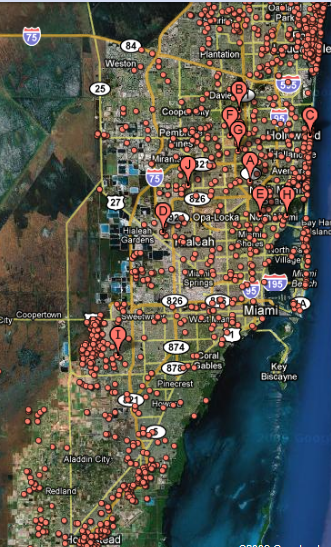

The foreclosure crisis is overwhelming the Miami-Dade legal system. One in every 28 homes in Miami-Dade County is in a state of foreclosure. Last year 56,656 foreclosures were filed in Miami-Dade County alone. Almost a third involve “owner-occupied homestead property” (residential homestead mortgage foreclosures) and a very large number of owners are unrepresented. The UM Foreclosure Defense Fellows will work to fill the gaps that this legal crisis has created within the South Florida community.

“These Fellowships engage the Law School and its recent graduates in a difficult but rewarding process that serves a great public need,” said Dean Patricia D. White.

Eight UM Law graduates were the winners of these fellowships. Six fellows – Siobhan Grant, Yolanda Paschal, Matthew Weintraub, Jaclyn Gonzalez, Francisco Cieza, and Bradley Shapiro – will work for the Legal Services of Greater Miami, Inc. (LSGMI). Two additional fellows – James Duffy and Berbeth Foster — will work at the Legal Aid Service of Broward County, Inc. They will receive a limited grant totaling $10,000 in exchange for working at least three days a week for 27 weeks, commencing in early October. The fellows will receive intensive training on October 2nd at a foreclosure workshop hosted by the UM School of Law, featuring April Charney, JD ’80, a consumer lawyer and nationally recognized foreclosure defense expert. The workshop will be held at the Whitten Learning Center on the University of Miami campus from 8:00 a.m. to 5:00 p.m.

In addition, three students from the School of Law’s LL.M. in Real Property – Jessica Davis, Dushyant Amish Jethwa, and James Walter – will inaugurate a clinical track in that program by providing 15 hours per week of free foreclosure defense representation. The LL.M students will work under the supervision of local lawyers who also will be working without pay. These fellows will be placed at “The Foreclosure Project,” created by Richard Burton, JD ’74, which provides free legal representation to homeowners facing foreclosure in Dade and Broward counties.

UM law professor A. Michael Froomkin describes how he came to create the Foreclosure Defense program: “Last fall, I was standing in front of the courthouse one evening talking to a local lawyer who was telling me about the thousand of foreclosure cases stacking up in the judges’ chambers, many with unrepresented parties who had valid defenses that were not being made because they didn't have a lawyer.” Froomkin recalls that the lawyer stated, “‘Someone should do something.’ And, right there, I decided that if no one else would do it, that it would be me.”

About Legal Services of Greater Miami

Legal Services of Greater Miami, Inc. provides innovative, effective legal services to help thousands of individuals in Miami-Dade and Monroe counties each year, creating a positive impact on the community as a whole. LSGMI is the largest provider of broad-based civil legal services for the poor in Miami-Dade and Monroe counties, and is recognized in the state and in the nation as a model legal services law firm. Its diverse staff provides clients with legal services in three languages from its main, regional and neighborhood offices.

According to Carolina Lombardi, LSGMI Senior Attorney who oversees the Mortgage Foreclosure Defense Project, “There is an unprecedented need for legal assistance for homeowners facing the loss of their homes through foreclosure and we cannot help everyone who asks for our assistance. Legal Services of Greater Miami, Inc. is thrilled to have recent UM law school graduates working with us so that we can provide legal help to more homeowners.”

Despite being staffed by six full time staff attorneys, LSGMI is only able to represent a fraction of the low income home owners in Miami-Dade County who are facing the loss of their family home. The addition of the University of Miami School of Law Mortgage Foreclosure Defense Fellows will expand the number of low income homeowners LSGMI is able to assist while at the same time training new attorneys to address this serious community need.

About Legal Aid Service of Broward County

Legal Aid Service of Broward County, Inc. (LAS) has provided free civil legal services to the poor in Broward County for over 35 years. In 2005, a regional office in Collier County was opened to serve the civil legal needs of the disadvantaged population in Collier County. Despite having an experienced, culturally diverse staff of 60, including 21 attorneys in Broward County, LAS can only meet the needs of 40% of the clients who seek their help.

“In Broward County, we have seen over a 600% increase in foreclosure case filings since 2006,” said Legal Aid Service of Broward County, Inc. Director of Advocacy Shawn Boehringer. “Even before the foreclosure crisis, we had insufficient resources to address foreclosures. We certainly have not seen a 600% increase in funding to assist clients since 2006. We applaud Professor Froomkin and UM Law School for starting this pilot and we are looking forward to working with the talent they have provided us. UM is a great law school, and our clients will benefit tremendously from the assistance the fellows will provide.”