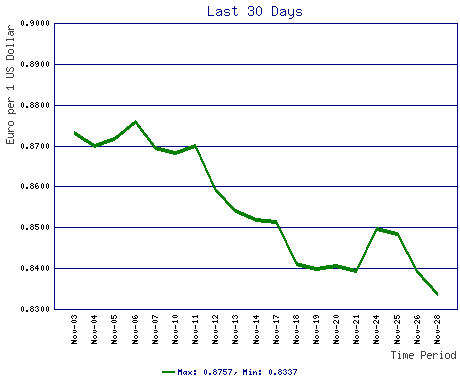

Once again justifying the Economist's Big Mac Index, which had been saying the dollar was overvalued, the dollar has been crashing against the Euro. This is particularly noteworthy as the Euro-area is not itself in the most wonderful economic shape. Which means that the currency traders think we're in even worse shape (click the imgage for details of the slide over the last 30 days). Lovely.

Once again justifying the Economist's Big Mac Index, which had been saying the dollar was overvalued, the dollar has been crashing against the Euro. This is particularly noteworthy as the Euro-area is not itself in the most wonderful economic shape. Which means that the currency traders think we're in even worse shape (click the imgage for details of the slide over the last 30 days). Lovely.

A Personal Blog

by Michael Froomkin

Laurie Silvers & Mitchell Rubenstein Distinguished Professor of Law

University of Miami School of Law

My Publications | e-mail

All opinions on this blog are those of the author(s) and not their employer(s) unelss otherwise specified.

Who Reads Discourse.net?

Readers describe themselves.

Please join in.Reader Map

Recent Comments

- Michael on Robot Law II is Now Available! (In Hardback)

- Mulalira Faisal Umar on Robot Law II is Now Available! (In Hardback)

- Michael on Vince Lago Campaign Has No Shame

- Just me on Vince Lago Campaign Has No Shame

- Jennifer Cummings on Are Coral Gables Police Cooperating with ICE?

Subscribe to Blog via Email

Join 51 other subscribers

What I fail to understand is why the high inflation rate in the economically strong euro-area states doesn’t have a negative impact on the euro: in Germany, prices on pretty much every item in the typical household shopping basket have risen an astonishing 100% since the conversion from DM to Euro. Normally I’d expect countries with this high an inflation rate to have rather weak currencies. What do I fail to see?

What about the rising trend of euro vs dollars. How many times will the euro worth will increase after UK will accept euro as its currency.

The value of the dollar vs the euro is directly related to the demand for dollars vs the demand for euros. Example: if we sell more products overseas, then our dollar is in higher demand, this is because we only accept dollars. The opposite is also true, if we sell nothing overseas, then the demand for the dollar becomes low.